wyoming tax rate for corporations

11 hours agoWyoming does not levy individual or corporate income taxes and its state sales tax rate is low at 4. Stock Dividends From C Corporations A C Corporation may pay shareholders dividends as a share of the profits of the company.

Start An Llc In Wyoming 2022 The Ultimate Guide

Wyoming charges a sales and use tax of 4 for which you will need a license to collect if you sell physical goods andor provide certain types of services.

. Corporate rates which most often are flat regardless of the amount of income. Wyoming Sales Tax Rates Wyoming does have sales tax. Personal Service Corporations may be taxed at a different rate.

The wyoming state sales tax rate is 4 and the average wy sales tax. On top of that rate counties in Wyoming collect local sales taxes of up to 2. Marginal Corporate Income Tax Rate.

Up to 25 cash back. Individual municipalities may add a. Cheyenne WY 82002-0110.

Wyoming does not have an individual income tax. If you use Northwest Registered Agent as your. Wyoming corporations and Wyoming LLCs are required to pay a fee each year when filing their annual report.

The current corporate tax rate federal is 21 thanks to the Tax Cuts and Jobs Act of 2017. Although we are not tax or legal professionals weve helped form a lot businesses and want to share our knowledge and experience. Address Lookup for Jurisdictions and Sales Tax Rate.

An S-Corp can be taxed more or less but avoids double taxation. Wyoming has a 400 percent state sales tax a max local sales tax rate of 200. Wyoming also does not have a corporate income tax.

Ad The tax landscape is transforming. In a three-factor apportionment state 20 percent of the companys income would be apportioned to the state for tax purposes the average across the three evenly-weighted. This fee is 60 or two-tenths of one million on the dollar 0002 of all in-state.

Please note new mailing address as we update. We include everything you need for the LLC. The state sales tax in Wyoming is 4 tied for the second-lowest rate of any state with a sales tax.

Herschler Building 2nd Floor West. Local sales taxes meanwhile are capped at 2. An S-Corp is not taxed at the same rate as a C-Corporation which is 21 at the time of this writing.

Wyoming Corporate Income Tax Comparison A home business grossing 55000 a year pays 000 A small business earning 500000 a year pays 000 A corporation earning 10000000 a year pays 000 12 - Wyoming Nonprofit Tax Exemptions. Wyoming Department of Revenue Website. Wyoming C Corp Tax Rate.

The bill would have levied an income tax on publicly traded companies with more than 100 shareholders an effort to extract revenues from big box stores like Walmart. This will cost you 325 for a corporation or an LLC. We recommend you form a Wyoming LLC or incorporate in Wyoming.

Up to 25 cash back Tax rates for both corporate income and personal income vary widely among states. The standard corporation tax rate is 21 percent.

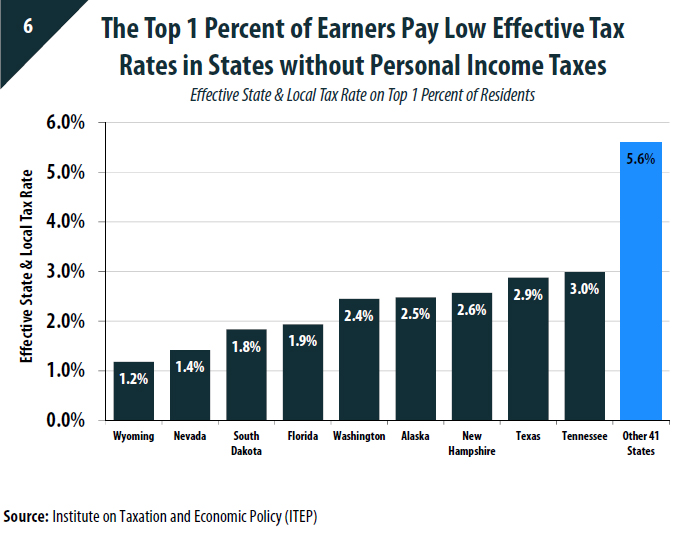

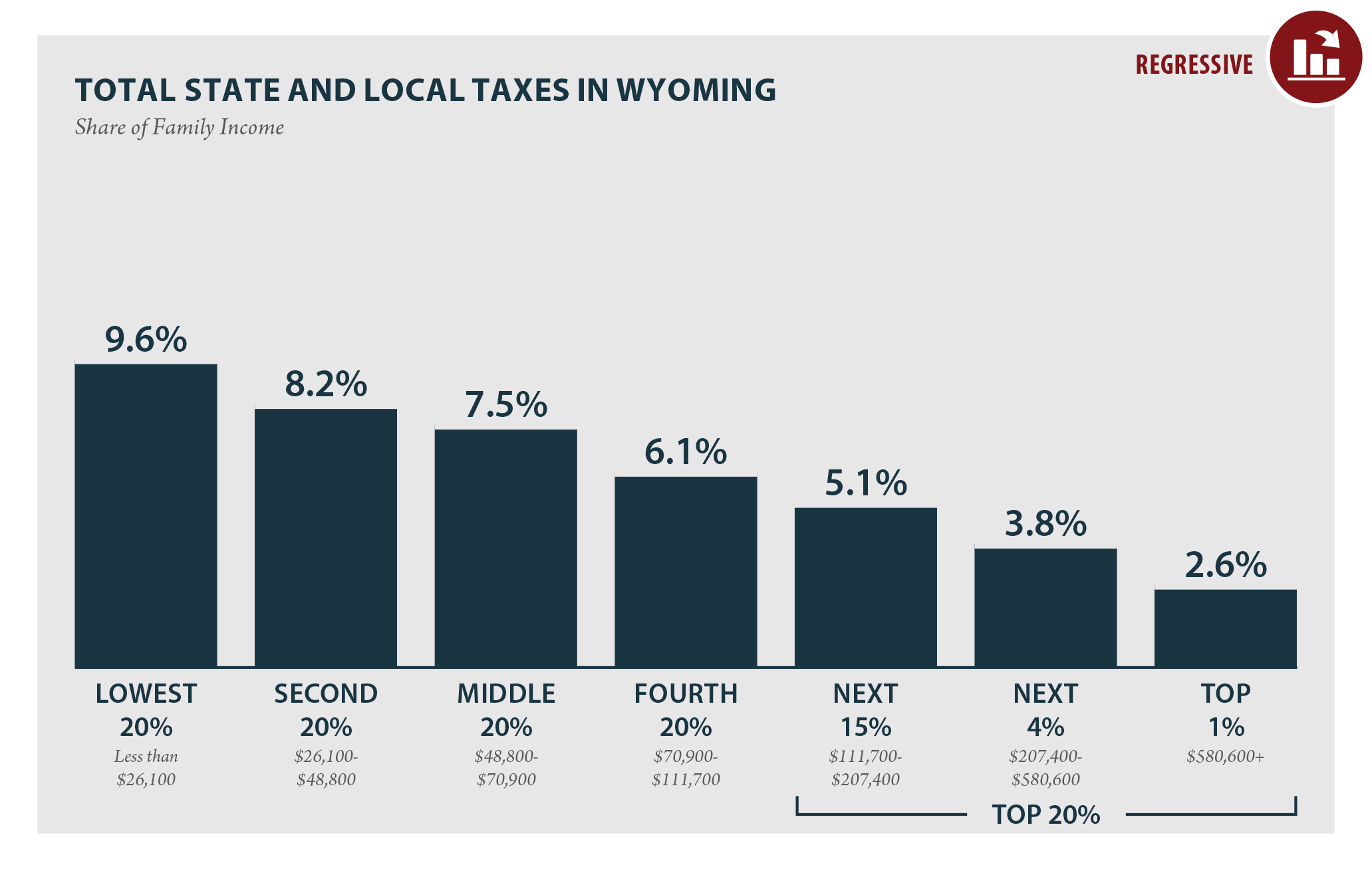

A Better Wyoming Everything You Know About Wyoming Taxes Is Wrong Itep

Wyoming 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Corporate Tax In The United States Wikipedia

Wyoming S Corp How To Start An S Corp In Wyoming Truic

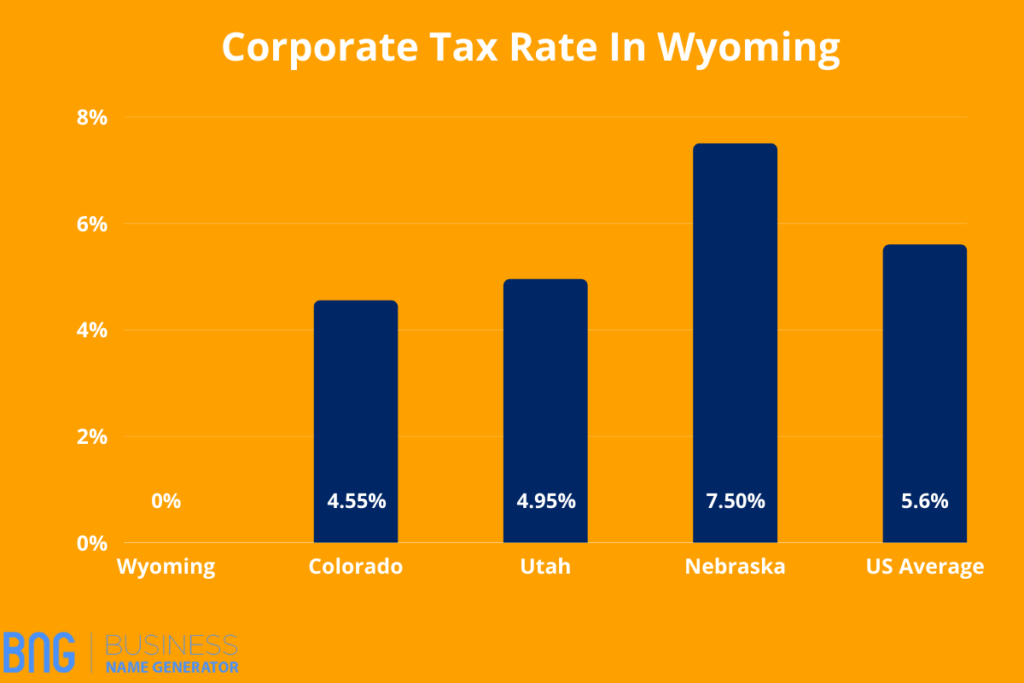

Corporate Tax Rates By State Where To Start A Business

Tax Benefits Of Living In Wyoming Wyoming Real Estate Blog

Wyoming Trusts Protected By Strong Privacy Laws Draw Global Elite Washington Post

State Sales Tax Rates 2022 Avalara

Historical Wyoming Tax Policy Information Ballotpedia

How Do State And Local Property Taxes Work Tax Policy Center

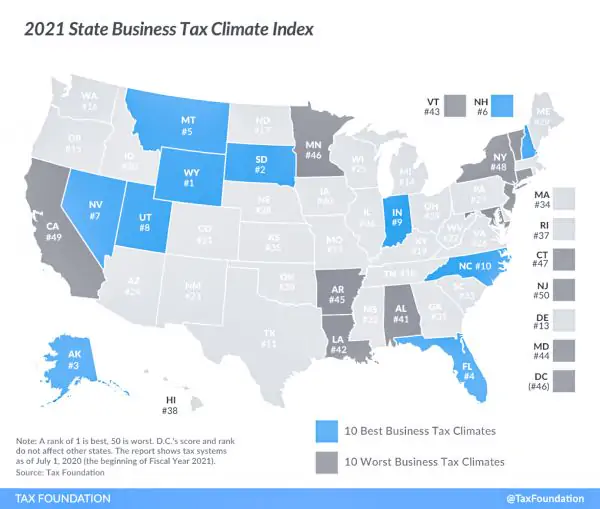

Wyo Named Most Tax Friendly State N Y Worst

Sales Taxes In The United States Wikipedia

Pandemic Profits Netflix Made Record Profits In 2020 Paid A Tax Rate Of Less Than 1 Percent Itep

Wyoming Income Tax Calculator Smartasset

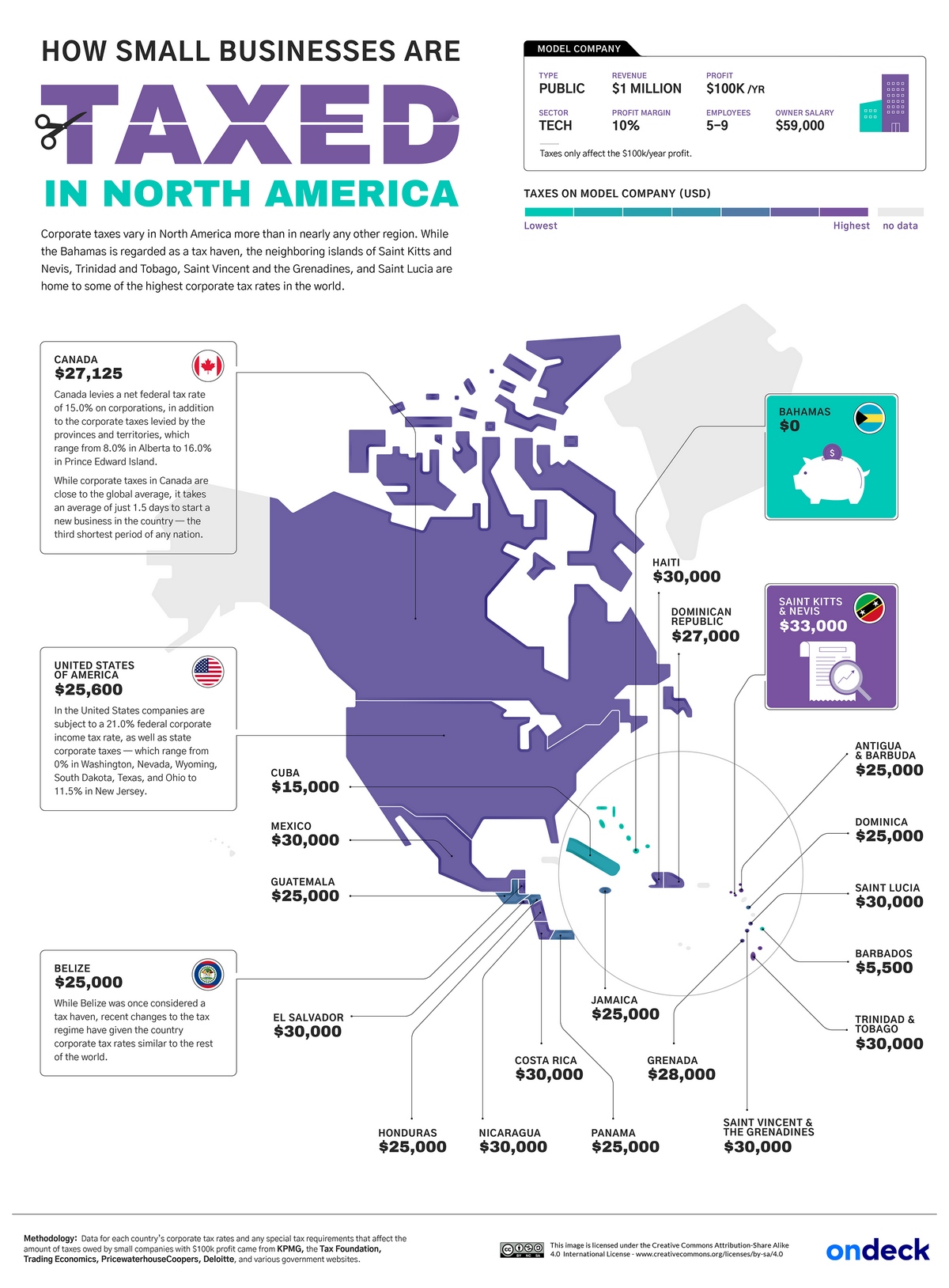

How Do Corporate Taxes For Small Businesses Vary Around The World Vivid Maps

Wyoming Llc How To Start An Llc In Wyoming In 11 Steps 2022

Wyoming Who Pays 6th Edition Itep